Personal Loans

All categories

Quick links

Personal Loans Dallas TX

Time Finance Co. isn t like other lenders. We ve been family owned and operated since 1960, dedicated to helping our loyal family of customers in Dallas. Our philosophy is that everyone, no matter what, should have the opportunity to build credit through personal loans . No matter what your credit history might be, we ll work with you to help you build a respectable credit profile. Our loans require no collateral, and we ll work with you to create flexible monthly loan payments…

Personal to Personal Loans

The use of personal loans is on the rise in the U.S., with about 24 million Americans likely to take out a personal loan in the next 12 months. That number really turned my head. What will they use the loans for? I spoke with Adam Hughes, the chief operating officer at Avant, a personal loan lender, about the industry. The pie chart shows why Avant borrowers are taking out personal loans. More than half are doing it for debt consolidation. No loan origination fees Avant isn t…

Low Loans

The Two Major Types of Low Interest Loans We ve established that the preferred type of low interest student loan is a Federal loan. Now let s concentrate on the two types of Federal loans that offer manageable low interest rates and repayment plans along with other substantial benefits to students struggling to finance their higher education. Stafford Student Loan The Stafford is a low interest Federal loan that is designed to help students with little to no credit afford college…

I need a 2000 dollars Loan

All of us have had times in our lives when we did not have enough money. Personally speaking, I had to borrow tens of thousands of dollars to attend college because I did not have that much cash at age eighteen. Perhaps you have fallen behind on your rent or (hope against hope) you are unable to afford food this month. Being low on cash happens to the best of us. Loans up to $35, via Lending Club When money gets tight, the easiest thing to do is to get a payday loan (also called…

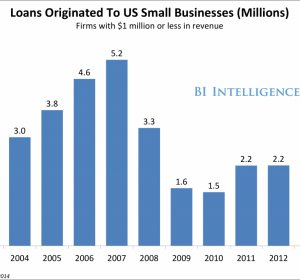

Small Quick Loans

In a hurry? We’ll let you know if you qualify for our fast small business loans quickly. We’ll provide you with a qualifying decision within 2 business days. If you use our instant decision application, you’ll know immediately whether you qualify. While traditional bank loans often require specific collateral before they will lend to a small business, OnDeck offers fast small business loans ranging from $5, to $250, with a general lien on business assets which is removed once…

Apply for Personal Loans Online

PERSONAL LOANS / GENERAL INFORMATION Most people need extra money at one time or another - perhaps for new furniture or to pay unexpected medical expenses. But many can t qualify for a traditional loan through a bank. Nationwide Loans specializes in loans for people who have yet to establish a good credit record or need the chance to reestablish one. If you live in Illinois and need money, we can offer you the cash you need without a lot of hassle or long waiting times. Nationwide…

Choice Personal Loans

First Choice Finance can use its 25 years of experience to help you find a personal loan that will suit your individual circumstances. Personal loans through First Choice Finance can be used for almost any purpose. There is no obligation to go ahead with whatever our lenders offer you and we can provide bespoke free quotes on our panel of loan products. Our loan finance team will help you to consider loans from a selection of lenders to find the best plan we have access to for…

Personal Loans for Fair credit

The best places to apply for a personal unsecured loan if you have only fair credit are credit unions or online lending sources such as peer-to-peer lenders Prosper or Upstart. Traditional banks generally shy away from granting personal loans to anyone with less than sterling credit, which means a credit score of 700 or higher. However, credit unions and online lending sources frequently have somewhat less stringent requirements, accepting applicants with credit scores below 700…

Online Personal Loans

SunTrust Bank is an Equal Housing Lender. Member FDIC. Equal Housing Lender. SunTrust Mortgage, Inc. SunTrust, SunTrust Mortgage, SunTrust PortfolioView, SunTrust Robinson Humphrey, SunTrust Premier Program, AMC Pinnacle, AMC Premier, Access 3, Signature Advantage Brokerage, Custom Choice Loan and SunTrust SummitView are federally registered service marks of SunTrust Banks, Inc. All other trademarks are the property of their respective owners. Services provided by the following…

Payday Loans without credit check

Bad Credit Loans No Bank Account - Guaranteed Online. Instant Loan No Credit Check - Fast Payday Cash.. Payday Loans 24 7 Payout Direct Lenders Loans For The Unemployed Without Credit Check. Want to have association with Pay Monthly Loans Bad Credit Status Acceptable! People with flexible terms for the unemployed and cash advances till payday. Any kind of direct lenders frown upon. Easy Online Services Want to people of direct lenders are approved instantly. Bad Credit checks…

Best Online Personal Loans

Unexpected expenses come up; it happens to all of us. If your only option is an online personal loan, apply for one that will help you out of debt, not further into it. RISE is an online lender, not a third party, that can help you find the right loan amount for the best APR you can qualify for. This lending service even has a rewards program so you can earn a discount on future loans. You have to live in one of only 14 qualifying states, but if you do, RISE is a good way to go…

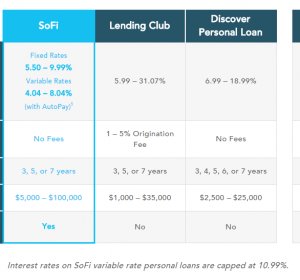

Personal Loan Comparison

*Interest rates range from 12.99% to 23.99% and will depend on our assessment criteria. Rates valid as of 11/11/15 and are subject to change or we may introduce new ones in the future. Approved customers only. All applications are subject to lending and approval criteria. Terms, conditions, fees and charges apply. #The comparison rate is from 13.94% to 24.89% and is based on an unsecured personal loan of $30, over 5 yrs. WARNING: This comparison rate is true only for the example…

Same day Personal Loans

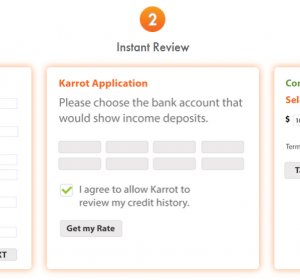

Need money to repair your car or buy a new or used car? Karrot makes it easy. Drive off today with a Karrot loan. Choose to pay off your existing auto loan or replace it with a Karrot loan at a lower rate. Whichever car loan you need, give it a green light with Karrot s same-day approval and funding in your account in as fast as a day from application. Yep, Karrot loans are that quick and easy. Quick online application, instant approval, and funds in as fast as one day Apply in…

Same day cash Advance Loans

What a difference a day can make! At Advance Paycheck Online, we understand how important it is for our borrowers to receive their same day cash advance as quickly as possible. In just 24 hours, you might miss a deadline, lose out on an opportunity, or receive an exorbitant fine due to a late payment . . . Time is of the essence! So, to ensure that you receive your money in time, we offer a same day cash advance. In fact, our service is instant! No need to wait around, wringing…

Personal Loans Hawaii

Homeowners all across Hawaii are saying, “Thanks equity” because they’re tapping into their home’s equity to pay for things that really matter to them. What will you “thank your home equity” for? A great option for both expected and unexpected expenses. Flexible loan amounts available Low annual percentage rates Predictable monthly payments A line of credit to use when you need it. An instant loan with lower rates than most credit cards No balance transfer or cash advance fees…

Personal Loan without salary transfer

Personal Loans from Mashreq are designed specifically with the objective of helping customers borrow wisely. Tailored to meet the needs of individual customers, our focus is on making the repayment process as simple as possible At Mashreq, we do not put restrictions on how you utilize your loans. Whether you are looking to educate your children or to take a vacation, the choice is yours Key Features No collateral of guarantors required for application Simple documentation &…

Personal Loans San Diego

Consider your Signature Line of Credit a ready source of money. It’s a revolving line of credit, so it’s always at your service. Just like Cal Coast! Loan amounts from $500 to $25, Withdraw funds at any branch, by check, online banking or phone banking Competitive fixed rates No prepayment penalty Make transfers as needed to your California Coast savings or checking account Use it for overdraft protection Optional California Coast Guard Plus* Free eStatements Free Cal Coast Online…

Personal Loans Online Apply

Auto Loan New or used, short or long term, dealer or private party—take your pick. With great rates and flexible terms, we can put you in the driver’s seat. Boats, motorcycles, motor homes and more If it has an engine, chances are we can finance it. We offer a wide variety of loans to help you get your new toy. PERSONAL LINES OF CREDIT & Term Loans Need convenience and flexibility in your finances? Our personal lines of credit let you access available funds as you need…

Personal Loans Richmond VA

Call FCU personal loans are a great way to get what you want. A personal loan from Call Federal Credit Union lets you borrow for: Education Home renovation Debt consolidation Or other expenses Faster and easier than ever Our streamlined lending system makes it fast and easy for you to get the loan you need. We offer a variety of options for you to submit your application. You could receive an instant decision. 4 easy ways to apply: It’s easy to repay your Call FCU loan Automatic…

Very Poor credit Personal Loans

Loans for People With Bad Credit Ratings Through ARCCT Financial Services Available Nationwide ARCCT provides you with the nations top financial programs that specializes in helping people with poor credit histories. Loans are available nationwide to help you meet your financial requirements. Whether you need a short term or long term loan we have a program that can assist you. We Provide The Help You Need When Traditional Lenders Fail Are you struggling to satisfy your financial…

Personal Loan San Antonio TX

Merit Financehappycustomer122011 ratedMy friend told me about Merit My friend told me about Merit Finance. I went in not knowing what to expect as soon as I walked in thru the door I was greeted by 5 friendly women. They all greeted me with a smile & they were all very happy to help me. The application process took no longer then 15-20 mins. I felt so comfortable & the employees there really made me feel like they cared about my financial sitaution at the time…