Please fill out all three fields of the form with numerical data.

How to Calculate Your Monthly Loan Payment

There are lots of reasons why you might want a personal loan. Perhaps it's to consolidate some credit card debt, or for a home repair project and maybe you'd like to invest in a small business. Whatever the reason, it's important to know just how much that loan is going to cost you in the long run. That's where a loan calculator comes in.

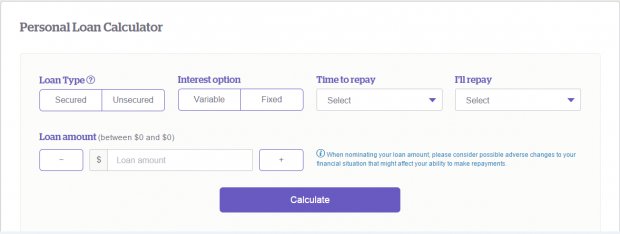

A loan calculator is a simple tool that will allow you to predict how much a personal loan will cost you as you pay it back every month. It's quite simple: You provide the calculator with some basic information about the loan, and it does the math and spits out your monthly payment.

You need to be prepared to provide the following:

1. The amount of the loan along with any up front fees.

2. The term or length of the loan (meaning how long you have to pay it back)

3. The interest rate of the loan.

The interest you pay for your personal loan will depend on your credit score and the information in your credit report. The higher your credit score, the lower you're interest rate will be, and the less you'll pay for your loan in the end. If you're not sure whether you have good credit you can use Credit.com's free Credit Report Card for an easy to understand overview of your credit report along with your credit scores.

Interesting facts

Additional information

|

Royal EZVue 8V Electronic Organizer PDA with 3MB Memory CE (Royal)

|