Here is a quick snapshot of the loan amounts and terms we offer in Utah:

State Loan Amounts| Minimum Loan Amount | Maximum Loan Amount |

|---|---|

| $1, 000 | $10, 000 |

| Minimum Loan Term | Maximum Loan Term |

|---|---|

| 6 months | 5 years |

Annual Percentage Rate

If you qualify for a NetCredit loan, we’ll work to match you with the lowest rate possible based on your selected loan amount and financial eligibility. We’ll also provide the full details of your loan offer—including interest rate, number of payments, payment amount, and total loan cost—before you ever sign a contract.

In compliance with the Truth in Lending Act the interest rate for your personal loan will be disclosed as an Annual Percentage Rate (APR). For a more detailed explanation of APR, please read “What is APR?”.

Fees

At NetCredit, we are committed to a clear and simple fee structure. The only fee you will ever pay us is the daily simple interest accrued on your loan. We’ll never charge any hidden fees like application fees, origination fees, late fees, non-sufficient funds (NSF) fees, or prepayment fees.

Of course we can’t speak for your bank, so it’s always a good idea to reach out to them directly if you have any questions about the fees they may charge.

Typical Loan Offers

The rates and terms for our personal loans are customized to each individual applicant, so the only way to know for sure what you can qualify for is to fill out an online application.

Generally, the rates and terms we can offer to eligible customers depend on several factors, including, but not limited to, credit history, employment history, and loan repayment history. We use these factors to group customers into multiple tiers, which are then matched to one of our specialized credit products: Gold, Silver, or Bronze.

See the table below for example loan offers for each category. These are just examples. If approved for a loan offer, the specific rates and terms of your loan agreement will be customized to your own unique financial situation.

Sample Loan Offers by Tier| Credit Tier | Loan Amount | Annual Percentage Rate (APR) | Number of Bi-Weekly Payments | Bi-Weekly Payment |

|---|---|---|---|---|

| Gold | $8, 800 | 35% | 130 | $145 |

| Silver | $4, 100 | 88% | 83 | $150 |

| Bronze | $1, 800 | 210% | 36 |

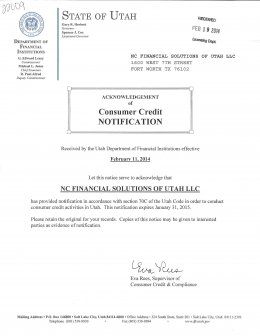

Compliance with Utah Regulations

We are proud to operate in compliance with Utah regulations.

Compliance with Federal Regulations

We also operate in compliance with all applicable federal regulations, including:

Governing Law

If we are unable to address your questions or concerns, you can also contact your state regulatory agency:

Department of Financial InstitutionsInteresting facts

Additional information