- Online payday loan customer

- Online payday loan customer

Payday loans are generally described as small, short-term loans. A consumer writes a check for the amount borrowed, plus a fee. The lender advances money against the check and the check is held until the next payday, when the loan and fees must be paid. Or, in the practice used by most online lenders, a consumer can grant the lender access to his bank account, and the lender electronically accesses the account to deposit money and withdraw payment.

Even paying back legitimate loans carries astronomical costs. Green took out a loan of $350. It took six weeks for her to pay it back, and she paid nearly $300 in fees.

Online payday loans boom

Her experiences are not uncommon. "Fraud and Abuse Online: Harmful Practices in Internet Payday Lending, " a 2014 study by the Pew Charitable Trusts, found online installment payday loans typically have an APR of 300 percent to more than 700 percent. Online lump-sum payday loans have a typical APR of 650 percent, or $25 per $100 borrowed per pay period. Exorbitant fees are also charged, and initial payments might not be applied to the loan's principal.

Online payday lending is big business. Revenue tripled from $1.4 billion in 2006 to $4.1 billion, according to Pew.

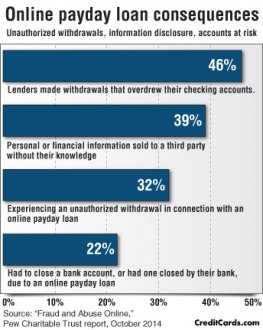

Of the more than 250 online payday borrowers surveyed by Pew, almost 40 percent said their personal information was sold to a third party without their knowledge. Nearly one-third had an unauthorized withdrawal from their account.

Threats were common, with 30 percent of those surveyed saying they were threatened by an online lender or debt collector.

"Harassment and fraud are really concentrated in the online lending market, " says Nick Bourke, project director for Pew's study on payday loans.

Part of the problem stems from the fact that there's no control over who can get your information once you apply for an online payday loan. "People's personal information can be spread far and wide, " Bourke says.

Even if the loans are fraudulent, a consumer's failure to pay them may be reported to one of the three main credit bureaus, Speer says, which can impact a consumer's ability to rent an apartment or land a job.

Many storefront payday lenders are fed up with the behavior of these online payday lenders.

"These unlawful lenders roam the Internet trolling for customers. They are scammers. They are fraudsters, " says Amy Cantu, spokeswoman for the Community Financial Services Association of America, which represents more than half of the country's storefront payday lenders.

Though online payday lenders represent just one-third of the marketplace, 90 percent of payday lending complaints filed with the Better Business Bureau are aimed at them, according to Pew.

Self-regulation efforts

Association members vow to adhere to the organization's best practices, which include complying with state and federal laws, being licensed in each state in which they do business and adhering to acceptable debt collection practices.

Some of the association's larger members also have an online presence, she says, but those sites also adhere to the organization's best practices.

Cantu says she understands that consumers with financial troubles may prefer the anonymity of the Internet when seeking cash, rather than walking into a storefront payday lender. But online lenders are supposed to only operate in the states that allow payday lending.Agencies crack down

Already the CFPB and the Federal Trade Commission are stepping up action against fraudsters. In a joint news conference in September, the agencies announced they'd filed suit against two online payday lenders.

|

These unlawful lenders roam the Internet trolling for customers. They are scammers. They are fraudsters |

| - Amy Cantu,

Community Financial Services Association of America |

The CFPB sued Kansas City-based Hydra Group, while the FTC sued CWB Services, also based in Kansas City.

The CFPB received more than 1, 300 consumer complaints about the Hydra Group.

At the news conference, CFBP Director Richard Cordray accused the Hydra Group of "running an illegal cash-grab scam to force purported loans on people without their prior consent. It is an incredibly brazen and deceptive scheme."

Both the Hydra Group and CWB Services were accused of buying personal information, including bank account numbers, from lead generators. The companies would deposit money into consumers' bank accounts without any signed agreements, and then make unauthorized withdrawals from the accounts. If a consumer complained, the companies would produce false loan documents.

In 15 months, the Hydra Group made $97.3 million in loans and collected $115.4 million from consumers.

Even if consumers closed their accounts, their information might have been sold to debt collectors, who then attempted to collect more money.

Interesting facts

Additional information