Stop applying for Bad Credit Business Loans!

Acquiring a business loan is not easy for businesses with bad credit. Getting approved for a business loan from a bank with a credit score of 650 or less can be extremely difficult. Unfortunately for young businesses bad credit is a common plight. Many entrepreneurs quickly learn that their initial business loan was helpful in establishing and starting up - but expansion, maintenance or even growth requires additional funding which may not always be available. New small businesses tend to damage their own chances for secondary financing during slow beginnings when fixed loan repayments are not always made on time. Other factors such as personal credit may also damage ones ability to be approved for a business loan as most lenders (banks and other financial institutions) look at a combination of both personal and business credit. Many business owners turn to private lenders, small loan companies, or even family or friends. Acquiring the necessary funds through these private channels is usually not realistic as funding amounts are typically limited.

Get a Business Cash Advance: Business Loan Alternative

Business cash advances are the best option for merchants with poor credit in need of small business financing. Cash advances offer the following benefits not available through bank bad credit business loans:

- Flexible repayment options!

- Bad credit not an issue!

Our simple online application takes only a few minutes to complete, and we can approve your business for an unsecured cash advance in less than 24 hours.

Stop turning to banks for business loans with bad or poor credit, get the financing you need quickly.

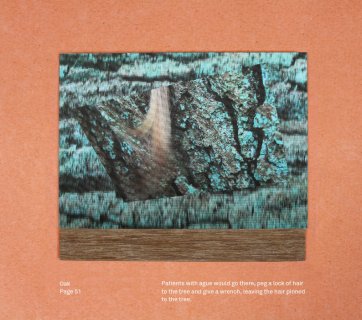

Interesting facts

Additional information