Paying to renew her license plates last month cost her $400, money that the 63-year-old widow would have much rather spent on Christmas gifts for her eight grandchildren.

Social Security survivors benefits go only so far, she said, and her family members “are just as hard up as I am.”

So LaCroix a few weeks ago went to the one place she knew she could get a quick financial fix: a payday lender. The transaction netted her about $300.

Easy money, sure, but LaCroix hasn’t forgotten about how it took her months to claw her way out from under a few hundred dollars’ worth of payday loans the last time she found herself in a pinch.

There are about 60 such storefronts in metro Omaha where, in about 15 minutes, people like LaCroix can walk in with a photo ID, a pay stub and a postdated check, and walk out with an unsecured, short-term advance of as much as $425.

However, proposed federal rules expected to be made public in early 2016 mean such businesses’ days could be numbered.

“The bureau is particularly concerned that lenders are offering these products without assessing the consumer’s ability to repay, thereby forcing consumers to choose between reborrowing, defaulting or falling behind on other obligations, ” Kelly Cochran, assistant director of regulations for the Consumer Financial Protection Bureau, wrote in the organization’s most recent agenda in late November.

The CFPB anticipates a release of its long-awaited rulemaking proposal in the first quarter of 2016; its primary aim seems to be to require all payday loan operators to tighten their standards and commit to such practices as better assessing the ability of borrowers to repay loans, or to take measures to limit the number of loans that can be taken out back to back.

Lenders fear a federal crackdown will cripple their business, and at least one national chain has already pulled out of Nebraska in response; that’s despite the fact that potential federal rules are unlikely to take effect for another year.

Meanwhile, locals intent on staying in business are anxiously awaiting the CFPB’s proposal.

“It’s going to be devastating both for the customer base and for the industry. I don’t see anything out there to replace it, ” said Brad Hill, president of the Nebraska Financial Services Association, which lobbies on behalf of the industry at the state level. “There’s a lot of criticism out there, but I don’t see anyone jumping in to fill the void.”

Even worse, Hill said, the coming proposal “is not consumer complaint-driven.”

Of more than 250, 000 complaints the CFPB logged in 2014, only 2 percent were about payday loans.

Historically, the onus has been on individual states to decide whether such businesses can operate within their boundaries and, if so, under what kind of terms.

States including North Carolina, Arizona and Arkansas prohibit payday lending.

In Nebraska, payday lenders cannot hold more than two checks from any single borrower, and the amount of those checks cannot exceed $500. They are allowed to charge a $15 fee for every $100 advanced to borrowers.

That means a $500 check postdated for the next payday would net a borrower $425.

Lenders in Iowa are subject to the same $500 limit on checks in their possession. They can also charge $15 on the first $100 but no more than $10 per subsequent $100 increments up to $500.

But the limit on the number of checks that a lender can hold from a single borrower does not prevent people like LaCroix from visiting different storefronts and taking out more loans than they can afford.

A proposal in the Nebraska Legislature in 2009 to establish a statewide database among lenders never advanced beyond committee hearings, though such efforts have been successful in other states. The goal of that proposal and others like it is to prevent the situation in which LaCroix finds herself, and the previous one.

She said her experience a few years ago took her “three or four months” to get clear. When the first advance she took out failed to cover her short-term needs, she said she went back again, and then again: “I’d go borrow $50 or $75 more, and then another $100.”

Once again, she’s gone back, multiple times in the past few weeks after being denied a small personal loan from a local bank.

“The last time, I didn’t borrow near as much as I have this time. It wasn’t around Christmas, so it’s now probably close to $600 between both (stores), ” LaCroix said. “I had to do it again. It’s like I had no other choice.”

Opponents criticize lenders’ relative inability to determine whether a borrower has been to another store. They also have leveled accusations that the fees they charge are exploitative and predatory.

“I believe these products and services are specifically intended to exploit low-income Nebraskans and to trap them in a vicious cycle of debt, ” said former State Sen. Danielle Conrad, who introduced legislation at the same time as the database proposal that would have capped the maximum annual percentage rate, or APR, of payday loans at 36 percent.

That measure also went nowhere.

Then as now, Nebraska’s effective APR on two-week loans totals about 460 percent, placing it among the highest in the nation.

“It’s no surprise that someone has a tough time paying that back and then taking care of everything else in their budget, ” said Rachel Anderson, director of faith affairs at the Center for Responsible Lending. “Then they have to take out another loan in a few days to repay the previous one and they’re out $50 right away.”

Accordingly, Anderson’s organization has been vocal in its opposition to the $46 billion payday loan industry and has lobbied federal lawmakers to expand regulatory oversight to include federal bodies like the CFPB.

At the same time, industry operators say math that calculates an APR on an instrument that is short term by definition is grossly misleading.

“We provide a service that, for all the criticism everybody gives us, no one else seems to want to provide, ” said lobbyist Hill, who also is an area manager of EZ Money Check Cashing.

“We get people sent to us from bank lobbies, ” Hill said, because financial institutions have little interest or motivation to lend small increments of money over a short period.

The Bellevue-based EZ Money chain has 35 locations in five states, including nine in the Omaha metro. That’s down from about 50 stores in seven states five years ago, Hill said.

Statewide, the number of payday loan operators and storefronts has also fallen over that time; it appears that the heyday of such businesses in Nebraska has passed.

Bad debt — that is, loans that borrowers have taken out but will not pay back — has skyrocketed, according to figures reported by the Nebraska Department of Banking and Finance, which regulates payday lenders in this state.

Interesting facts

Additional information

|

PaydayLoansBBB Mobile Application (PaydayLoansBBB)

|

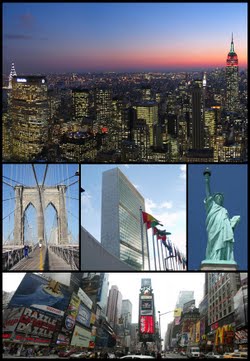

This article is about the city. For other uses, see New York City (disambiguation). For the U.S. state, see New York.

This article is about the city. For other uses, see New York City (disambiguation). For the U.S. state, see New York.