Filed For Bankruptcy?

Filed For Bankruptcy?

Here at Auto Credit Express we can help you get approved for vehicle financing even while you're going through awful situations like bankruptcy and repossession. Obtaining an auto loan after bankruptcy discharge is one of the best ways to help you rebuild your credit score, and even if you have not completed the bankruptcy process you're still eligible for an open bankruptcy auto loan. Get back on the road today in a car from one of our national car dealerships that accept bankruptcy clients and specialize in subprime lending.

We're a Special Financing Company Poor credit scores can leave you looking for a special finance company, like us, to help you when you want to purchase a new or used car. The good news is that if you're reading this you do not need to look any further for a company that can get you approved auto financing. We specialize in helping people who traditional lenders do not want to lend to - and we can help you right now. If you have a reliable income you can be approved for a special finance car loan in a matter of minutes.

Poor credit scores can leave you looking for a special finance company, like us, to help you when you want to purchase a new or used car. The good news is that if you're reading this you do not need to look any further for a company that can get you approved auto financing. We specialize in helping people who traditional lenders do not want to lend to - and we can help you right now. If you have a reliable income you can be approved for a special finance car loan in a matter of minutes.

Leasing & Buying Programs

We have people ask us all the time, "Is it better to sign a lease for a vehicle or try to get approved for a loan?" The answer isn’t so straight-forward because each person’s financial situation, credit history and vehicle requirements are different. These factors play a large role in deciding whether leasing a car or taking out an auto loan is the better choice. By evaluating our customers’ needs, we can more accurately decide what financing option is going to be the most beneficial for them.

Interesting facts

Additional information

|

Liili Premium Samsung Galaxy Note 3 Aluminum Snap Case Money in the back jeans pocket IMAGE ID 16916911 Wireless (Liili Products)

|

|

Liili Premium Samsung Galaxy Tab 4 7.0 Inch Flip Wallet Case Japanese yen Image ID 21692206 Wireless (Liili Products)

|

|

Liili Premium Apple iPhone 6 Plus iPhone 6S Plus Aluminum Case Japanese yen Image ID 21692206 Wireless (Liili Products)

|

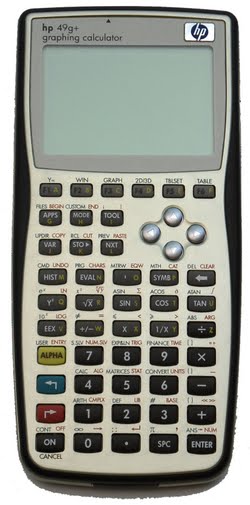

An electronic calculator is a small, portable, usually inexpensive electronic device used to perform the basic operations of arithmetic. Modern calculators are more portable than most computers, though most PDAs are comparable in size to handheld calculators.

An electronic calculator is a small, portable, usually inexpensive electronic device used to perform the basic operations of arithmetic. Modern calculators are more portable than most computers, though most PDAs are comparable in size to handheld calculators. A graphing calculator (also graphics / graphic calculator) typically refers to a class of handheld calculators that are capable of plotting graphs, solving simultaneous equations, and performing numerous other tasks with variables. Most popular graphing calculators are also programmable, allowing the user to create customized programs...

A graphing calculator (also graphics / graphic calculator) typically refers to a class of handheld calculators that are capable of plotting graphs, solving simultaneous equations, and performing numerous other tasks with variables. Most popular graphing calculators are also programmable, allowing the user to create customized programs...