Loans made through the Federal Perkins Loan Program, often called Perkins Loans, are low-interest federal student loans for undergraduate and graduate students with exceptional financial need.

Here’s a quick overview of Federal Perkins Loans:

- Available to undergraduate, graduate, and professional students with exceptional financial need.

- Interest rate for this loan is 5%.

- Not all schools participate in the Federal Perkins Loan Program. You should check with your school's financial aid office to see if your school participates.

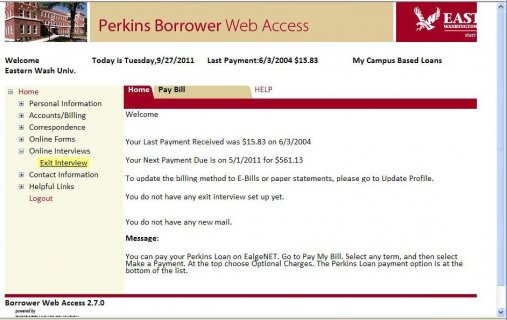

- Your school is the lender; you will make your payments to the school that made your loan or your school’s loan servicer.

- Funds depend on your financial need and the availability of funds at your college.

Am I eligible for a Perkins Loan?

You may be eligible for a Perkins Loan if you

- are an undergraduate, graduate, or professional student with exceptional financial need;

- are enrolled full-time or part-time;

- are attending a school that participates in the Federal Perkins Loan Program; and

- meet other eligibility criteria.

If you have questions about Perkins Loan eligibility, please contact your school’s financial aid office.

How much can I borrow?

The amount you can borrow depends on your financial need, the amount of other aid you receive, and the availability of funds at your college or career school. You should apply for federal student aid early to make sure you are considered for a Perkins Loan. Due to limited funds, not everyone who qualifies for a Perkins Loan will receive one.

If you are an undergraduate student, you may be eligible to receive up to $5, 500 a year. The total you can borrow as an undergraduate is $27, 500.

If you are a graduate or professional student, you may be eligible to receive up to $8, 000 per year. The total you can borrow as a graduate student is $60, 000, which includes amounts borrowed as an undergraduate.

Other than interest, is there a charge for a Perkins Loan?

No, there are no other charges. However, if you skip a payment, if your payment is late, or if you make less than a full payment, you might have to pay a late charge plus any collection costs.

How will I receive my loan?

The school will apply your loan funds to your school account to pay for tuition, fees, room and board, and other school charges. If any loan funds remain, your school will issue you a refund to help pay for your other education expenses.

Can I cancel a loan?

Yes. Before your loan money is disbursed, you may cancel all or part of your loan at any time by notifying your school. After your loan is disbursed, you may cancel all or part of the loan within certain time frames. Your promissory note and additional information you receive from your school will explain the procedures and time frames for canceling your loan.

When do I have to pay back my Perkins Loan?

If you are attending school at least half-time, you have nine months after you graduate, leave school, or drop below half-time status before you must begin repayment. If you are attending less than half-time, check with your college or career school to find out how long your grace period will be.

Interesting facts

Additional information