Payday loans are a risky business as they come with extremely high interest rates and a very short term before payment is due. The idea of payday loans is attractive to many people who find themselves in tight financial spots. You borrow a certain amount and then repay the principal and interest on your next payday. However, a large number of borrowers find that when their next paycheck comes in, they do not have the cash to spare.

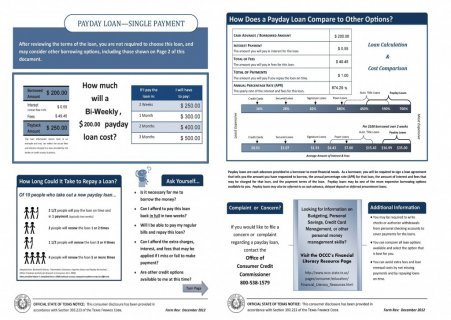

The interest rates associated with payday loans are unsettlingly high, averaging between 300% and 800%. Companies justify these rates because they represent a full year's interest yet the standard term of a payday loan is between two and four weeks. However, when customers cannot repay their loan, many services offer extensions, rollovers or renewals. While these options provide additional time to repay a loan, they also extend the time in which interest is accruing and those higher rates start making a marked difference.

Unfortunately, you may find yourself with no other choice and nowhere to turn besides payday lenders. While we strongly recommend you avoid payday loans at all costs, we also want to ensure that you have as much information as possible if you decide to accept one. Many lenders have sketchy lending histories and become the subject of investigations and lawsuits or simply are required to pay fines due to questionable practices or customer harassment. When this information comes to our attention and affects any service on our lineup, we remove that service.

Our top three services, 100DayLoans, NetLoanUSA and 24/7Loan, offer some of the best online payday loans in San Antonio. We also have included a number of companies that have local branches in San Antonio that are viable options. If you need more information about payday loans in San Antonio, take a look at our articles on San Antonio payday loans.

Payday Loan Companies: What to Look For

Before selecting a payday loan provider, your best option is to know what to look for in a payday loan and avoid those loans that have higher-than-average rates and fees. Texas and San Antonio have regulations to help protect you from certain predatory loans, but education is the best protection you can provide for yourself.

One important aspect of payday loans in Texas is that the state does not allow direct lenders. Rather, the services on our lineup connect you with third-party lenders to complete your loan. Because of this, many services can only provide general ranges for things such as the loan amounts, APRs, terms and fees. The lender ultimately decides the exact numbers. The following are the elements of payday loans we think you should know about and consider before agreeing to any loan.

Loan Features

Texas does not have a cap on the amount of a payday loan, but San Antonio does. By law, lenders cannot provide a loan that exceeds 20% of your monthly income. For example, if you make $2, 000 a month, the largest loan lenders can legally offer you is $400 even though some services may advertise the potential for thousands of dollars. Lenders are also not likely to offer the full amount to first-time applicants.

Because of the cap on the amount, the maximum loan amount a service offers becomes less important because most services offer up to $1, 000, and unless you take home $5, 000 a month, you cannot receive the full $1, 000. The APR and fees then become more important, so you want to find the lowest APR possible. Unfortunately, there is little chance of avoiding APRs that range from 300% to 600%. Some services have even higher APRs that exceed 1000%. There is a very good chance that you can get an APR less than 600% if you shop around before you agree to anything higher. All services charge a fee per $100 borrowed, and that averages around $20. $30 is the highest fee on our lineup but plenty of services charge less.

Ease of Use

We looked closely at the choices and process for getting a payday loan. Many services offer both online and in-store loans. However, some services only offer in-store loans, which means that you must drive to the store to pick up your money. While in-store loans are nice because you get your money immediately, this may be a less convenient option for many people. You can complete an online loan from home, but many services don't deposit your funds until the next day. The best payday loans in San Antonio offer same-day direct deposit of online loans so you get your funds the same day without having to leave your house.

Repayment Terms

The maximum term of most payday loans is two to four weeks. However, because the purpose of a payday loan is to supplement your finances between paychecks, the term of your loan typically depends entirely on your paycheck schedule. When that term is up, you are then required to repay your loan, either in full or by beginning your payment schedule. The majority of services – and for all online loans – automatically debit your checking account when the payment is due.

Some lenders may offer extensions or loan rollovers if you are not able to make your payment when it is due. San Antonio law limits loan rollovers to three, and at that point, you must pay off the remaining balance, and if you accept a rollover or extension, each of the following payments must reduce the balance by at least 25%. Either option may come with penalties or fees for not paying off your loan when you originally agreed to pay it off.

Help & Support

Most payday loan services provide several options for reaching customer service. All services on our lineup have an email option. However, we had very little success receiving responses from the majority of companies when we contacted them by email. All of the services also offer phone support, which is a better means of contact than email. If a service offers live chat, that can be a very useful resource. You also can go into any of the local San Antonio branches and talk to a representative face to face. Some services have very comprehensive and useful websites that provide a great deal of information, including APRs, fees and even financial advice. However, other services seem to hide information, so you should consider taking a look at the company's website to see how forthcoming it is with certain information.

Again, payday loans are a risky choice with the extremely high interest rates they unavoidably entail. San Antonio and the state of Texas employ some regulations to keep you from suffocating under debt, but ultimately, you want to understand everything you can about a payday loan before you accept any offer.

Interesting facts

Additional information

|

Payday Advance Loans Windless Swooper Feather Banner Flag Sign Office Product (Accent Printing & Signs)

|