In Dallas, Austin, San Antonio, Brownsville, Irving, Mesquite, Sachse, Richardson, Garland and Little Elm, city governments have passed zoning ordinances to limit the expansion of payday lending businesses in their cities.

The ordinances come on the heels of 2011 regulations passed by the Legislature, which some city councils felt were not comprehensive enough. The recent state laws require payday and auto title lenders to be regulated by the state and to post a schedule of fees in visible places in their businesses, similar to the overhead menus in fast-food restaurants.

Critics say that the short-term, high-interest loans by such lenders has led thousands of Texans into a cycle of debt and dependency.

“In Dallas and Austin, we are leading the fight at the local level, because the state has been hindered by the significant lobbying effort that the industry has taken on, ” said Barksdale English, a policy aide for Austin City Councilman Bill Spelman, who authored a recently approved zoning ordinance that limits where payday and auto title loan businesses can be located.

“[The industry] definitely hired two of the most active and influential lobbyists here in Austin, ” English said, referring to lobbyists from the firm Armbrust & Brown. “Their lobbyists have been in constant contact with our office since December. In the course of the last 10 days leading up to the vote, they were meeting with other council members as well.”

Armbrust & Brown did not return calls seeking comment.

The Texas Constitution says annual rates of interest of more than 10 percent are illegal. However, this constitutional protection can be bypassed if payday lenders register their businesses as “credit service organizations, ” which under state law are defined as organizations that improve a consumer’s credit history or rating, or obtain an extension of consumer credit for their clients. Some payday and auto title loan companies charge interest rates of up to 500 percent.

“There was a huge push to have some consumer protection ... that would reduce the cycle of debt and the huge charges that are part of [the payday and auto title lenders’] business model, ” said Ann Baddour, a senior policy analyst for Texas Appleseed, a nonprofit advocacy and research group. “Nothing that directly addresses the business model passed the Legislature last session. The cities have felt the pressure to take action.”

Last year, the city of Dallas passed an ordinance that required payday and auto title lenders to register with the city, and restricted the amount of loans that can be extended and the terms of repayment. The Consumer Service Alliance of Texas filed a lawsuit in response. CSAT said the ordinance conflicted with state law and limited credit access for Dallas residents. The association also filed a similar lawsuit against the city of Austin for a different payday-lending ordinance, which capped the maximum loan amount and restricted the number of times a payday loan can be refinanced. Both lawsuits are still in litigation.

“CSAT respects the right of a city to impose reasonable spacing, parking, and signage guidelines on businesses that operate within the city limits, ” the association said in a recent statement. “However ... when ordinances restrict access to credit [and] eliminate consumer choice ... the ordinances have gone too far and will have unintended consequences.”

Interesting facts

|

PaydayLoansBBB Mobile Application (PaydayLoansBBB)

|

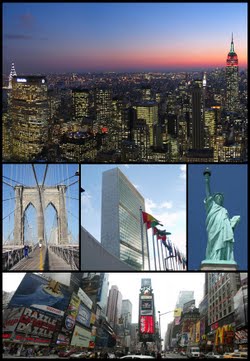

This article is about the city. For other uses, see New York City (disambiguation). For the U.S. state, see New York.

This article is about the city. For other uses, see New York City (disambiguation). For the U.S. state, see New York.