We’ve talked before about how to pay off debt using the debt snowball—a strategy that allows you to pay off small accounts quickly while maintaining a psychological edge over your debt. While the snowball method is a great one, it’s actually not the most efficient method and won’t help you pay off debt fast like the debt ladder will. In the second installment of our “How to Pay off Debt on Your Own Series, ” we are going to teach you how to pay off debt fast, in a way that has mathematical advantages. Just keep in mind that “fast” here is a relative term. You won’t close out individual accounts at lightning speed, but this method will help you become totally debt free in the fastest way possible.

We’ve talked before about how to pay off debt using the debt snowball—a strategy that allows you to pay off small accounts quickly while maintaining a psychological edge over your debt. While the snowball method is a great one, it’s actually not the most efficient method and won’t help you pay off debt fast like the debt ladder will. In the second installment of our “How to Pay off Debt on Your Own Series, ” we are going to teach you how to pay off debt fast, in a way that has mathematical advantages. Just keep in mind that “fast” here is a relative term. You won’t close out individual accounts at lightning speed, but this method will help you become totally debt free in the fastest way possible.

Ok, think of debt as the top of a ladder—you know that tall, intimidating unstable piece of metal you use to do dangerous things like clean gutters and cut trees. See the connection? We want to come down from that ladder and re-establish some firm financial footing. Not only that, but we want to pay off our debt fast, in the quickest and most efficient way possible, so that we don’t waste any money on extra unnecessary interest. This one is for you, math nerds. Let’s take a closer look.

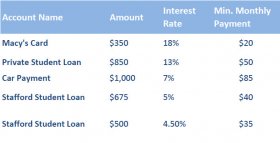

Step 1: List each of your debts in order from largest to smallest interest rate.

Step 2: Set aside the funds to make each minimum monthly payment. Then, put any extra funds toward the account with the highest interest rate. In our monthly budget, we have $500 to pay off debt each month, and the total of our minimum payments is $230 (leaving us a $270 surplus):

After the first month, we have almost closed the Macy’s account. While we have still been paying interest on other debts, we are doing so at a lower percentage than the Macy’s account, saving us money in the long-term. As you can see, next month we will pay off the Macy’s account in full. Once we account for interest, we will spend .23 on Macy’s and will have a 3.77 surplus to put toward the next account—our private student loan. Our private student loan will go from a balance of 9.21 to a 7.98 after interest and our minimum payment. But, since we closed the Macy’s account, we still have a surplus of 3.77, and our student loan will drop to 4.21!

Why the debt ladder method works

Why the debt ladder method works

Basically, the principal (the amount before interest) of your debt is not as important as the interest rate, because the interest rate determines how quickly your debt will grow and how much more you will have to pay each month. By following the ladder method, you minimize the amount of interest paid. This means that you pay less overall.

The Fastest Way Isn’t for Everyone

When we talked about how to pay off debt with the snowball method, we kept reiterating the psychological boost. That’s what the debt snowball is all about. The debt ladder method is much different. Even though this method allows you to pay off debt fast (keep in mind, this is total debt), it might take you a while to actually close an individual account in full. In our example, we did it quickly, but this won’t always be the case. Let’s be honest, closing an account in full is extremely rewarding for consumers who are figuring out how to pay off debt. Each time you close an account, you’ve reached a milestone. Just know that with the ladder method, this might not happen as quickly.

If you expect quick results and get frustrated easily, the ladder method may not be for you. You don’t want to get discouraged and give up, leading to more debt down the road. Instead, go for the debt snowball. If you are good with long-term planning and can accept delayed satisfaction, make sure you understand how to pay off debt with the ladder method—it’s probably a good option for you. It certainly is the “best” way if you can be patient; and remember, this is the fastest way overall, it just might feel slow in the short-term.

Deciding how to pay off debt based on the type of debt

You might be thinking; “Does the ladder method work better for certain types of accounts?”

The answer is yes and no. The ladder method will always be more efficient than the snowball method and will allow you to pay off debt fast. But with that said, the debt snowball works well for small accounts, like retail credit cards (think Macy’s, Old Navy, etc.) The ladder method is probably easier for larger accounts, like student loans, which are going to take a while to pay off anyways.

Remember, ClearPoint wants you to know how to pay off debt on your own if at all possible. And, of course, we want you to pay off debt fast so you can start planning for other financial goals. But, if you have a high debt-to-income ratio, through, you might need some extra help. Figure out your debt-to-income ratio, and if it’s over 15% get started with a free budget review and credit counseling session. We hope you now know more about how to pay off debt—thanks for reading!

Interesting facts

Additional information

![How To Raise Money For Your Business Fast [business loans]](/img/video/how_to_raise_money_for_your.jpg)