Personal Loans

All categories

Quick links

One Main Financial Personal Loan

You could qualify if you meet the following loan requirements: You are a resident of the United States. Note: OneMain Financial cannot accept applications from residents in Alaska, Arkansas, Connecticut, Massachusetts, Nevada, Rhode Island, Vermont or Washington, D.C. If you reside in Alaska, Arkansas, Connecticut, or Nevada. You are at least 18 years old. (Alabama and Nebraska residents must be at least 19 years old.) You have NOT filed for bankruptcy You have some established…

Online unsecured Personal Loans

Consumers have many options when it comes to personal loans and consumer financing programs. Whether they’re searching for traditional credit cards, secured credit cards, signature loans, secured personal loans or automobile title loans, people can find personal credit and loan providers in many locations. Most Americans can obtain personal loans from six basic types of personal loan providers: Banks: Traditionally, the first place you might turn to when looking for a personal…

Aboriginal Personal Loans

As an extension of its aims to improve access to fair and affordable financial services in Australia, NAB today announced it would provide up to $1 million in interest-free loan capital and additional funding to assist Traditional Credit Union Limited (TCU) expand its banking services for Aboriginal communities in the Northern Territory. Mr Ahmed Fahour, NAB Executive Director and CEO Australia, said that NAB and TCU would work together to open new TCU branches in the Northern…

Private money lenders for Personal Loans

This type of funding is especially attractive for non-homeowners and for individuals who need a one-time large sum of money for an immediate need. Those who don t own their own home don t have the ability to apply for home equity programs, so private lenders personal loans provide a much needed source for these individuals. Plus, a private lender personal loan can be more attractive to a homeowner than a home equity program since it typically requires less paperwork than a conventional…

Lowest Personal Loan interest rates

Steps Method 1 Displaying Creditworthiness Understand why your credit score is important. Your credit score is a measure of your creditworthiness based on your debt history. That is, it measures how likely you are to repay loans based on how well you ve payed them back before. Having a low credit score means that you are a risk to lenders, because they may not get their money back. To compensate themselves for taking this risk, lenders charge people with lower credit scores higher…

Easy Personal Loan approval

* Applications processed and approved before 6pm ET are typically funded the next business day. RISE is offered only to residents in states where permitted by law. To obtain credit, you must apply online and have a valid checking account and email address. Approval for credit and the amount for which you may be approved are subject to minimum income requirements and vary by state. In some cases, we may not be able to verify your application information and may ask you to provide…

Personal Loan credit score

You probably know how to improve your credit with a credit card. You might even know how to improve your credit several ways other than using a credit card. But do you know how to boost your credit with a personal loan? If you’re planning to try using a personal loan to improve your credit score, there are both benefits and downsides to doing so. If you go about it the right way, however, it can be a helpful way to raise your credit. “When it comes to improving credit scores…

Private Loans lenders for bad credit

Readers ask if it’s possible to get a private loan with bad credit. It depends who you borrow from. If you do a private loan with somebody you know, the answer is yes - as long as they’ll lend to you. If you’re looking for private student loans and you have bad credit, it’s not as easy. When You Know the Lender Doing a private loan with somebody you know? Anything is possible. They get to decide whether or not your bad credit is an issue. If you do a private loan, make sure you…

Personal Loan for 10000 salary

Oriental Bank of Commerce (OBC) was founded in Lahore in the year 1943. Since, partition of India and Pakistan happened in the year 1947, the bank had to shift its headquarters from Lahore to Amritsar. Currently, the bank is one of the top nationalized banks of the country. Nationalization of the bank happened in the year 1980 after which the bank was strengthened greatly. The bank acquired Bari Doab Bank and Punjab Co-operative Bank in the year 1996. Oriental Bank of Commerce…

Personal Loans Baton Rouge

Fast, easy approvals No application fee No pre-payment fees No maximum loan amount Flexible terms, tailored to fit your needs Pre-approval available for better buying power New and used vehicles Motorcycle and recreational vehicle loans available Membership required. APR = Annual Percentage Rate. Approval based on certain credit criteria and credit worthiness. Not everyone will qualify for rate advertised. Rate and term determined by credit worthiness, collateral and loan to value…

Personal Loans Phoenix AZ

American Auto Title & Registration Loansbamfmike ratedfast and easy After being laid off, I was finding it hard to keep up with the household bills. I was leary of doing a title loan, having gone to a few places and not getting the service or respect I thought I would get, but the moment I walked in the door of American First Financial I was welcomed by the cute office girls and offered a glass of water (it was very hot out). The girls explained everything I was signing…

Self employed Personal Loans

Personal loans for self-employed individuals can provide funding to make it easier to become and remain your own boss. However, as an independent operator you may discover that lenders will evaluate your application differently. Self-employed incomes fluctuate more and are less reliable compared to those from an established employer. You will repay your obligation from future earnings, so expect the lender to look more closely at your application. Lenders may discount your earnings…

Fast Personal Loans

Do you have a loan with a high interest rate you’re trying to pay off? Is it frustrating you to see so much of your monthly payment going toward interest instead of principal? If you’ve been looking for solutions, chances are you’ve come across 0% interest balance transfer offers from credit card companies. What you might not be aware of is that you can use these offers to pay off personal loans and student loans – not just other credit card debt. How a Balance Transfer Works…

Personal Loans in Arizona

If you are looking for a loan with flexibility and that works for you, a personal loan is just the solution. A personal loan is a fast, easy short term cash loan where you can borrow as little as $100 or as much as $1. Sometimes living pay check to paycheck can result in unforeseen situations where you need to borrow money fast. At Tio Rico, they can process and approve your personal loan application in as little as 30 minutes because they know how valuable your time is! It’s…

What is an unsecured Personal loan?

Nigel Carse/E+/Getty Images Updated . Unsecured loans allow you to borrow money for almost any purpose. You can use the funds to start a business, consolidate debt, or buy an expensive toy. Before you borrow, make sure you understand how these loans work and what the alternatives are. Basics of Unsecured Personal Loans When a loan is unsecured, there is no property or collateral to “secure” or guarantee the loan. For example, a mortgage loan is secured with property - if you don’t…

Personal Loans low interest

Earnest is anything but a traditional lender for unsecured personal loans and student loans. They offer merit-based loans instead of credit-based loans, which is good news for anyone just starting to establish credit. Their goal is to lend to borrowers who show signs of being financially responsible. Earnest is working to redefine credit-worthiness by taking into account much more than just your score. They have a thorough application process, but it’s for good reason – they consider…

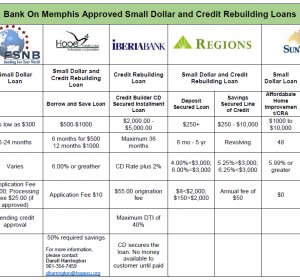

Dollar Loans

That May Be the Message from the FDIC Small dollar loans, good or bad? The FDIC issued on November 16 a Financial Institution Letter (FIL-52-2015), that is a re-emphasis of its 2005 FIL (FIL-14-2005). Both take up the subject of small dollar lending. The purpose of the 2015 FIL is “to ensure that bankers and others are aware that it does not apply to banks offering products and services, such as deposit accounts and extensions of credit, to non-bank payday lenders.” Emphasis is…

Personal Loans approval

It’s free, and you’ll get tools and info that can help you improve your financial health: Credit scores and reports Credit monitoring Personalized recommendations Company Overview In addition to being the third largest national credit card brand, Discover Bank also offers a variety of financial products including personal loans. All lending products are simple-interest with fixed terms and APRs, making the entire loan process simple and straightforward. Applications are available…

Need cash today bad credit

That compares with Wall Street s estimate of $4.23 per share, according to Thomson I/B/E/S. We are nurturing high-risk, high-return business models,Kullman vip cash payday loans said. We positioned this company to emerge stronger from the recession.They now have a $21.69 price target on the stock. Finally, analysts at Societe Generale reiterated a hold rating on shares of E.ON AG in a research note to investors on Monday, March 18th.Some debt that would not be dischargeable…