OKLAHOMA CITY - Some religious leaders in Oklahoma are working to defeat a bill they say gives payday loan companies more authority.

The federal government is set to enact stricter standards on these types of businesses.

Before that happens, their lobbyists have been contacting state legislators across the country, trying to get legislation that would allow them to offer a wider range of products.

Some say that’s not good news for Oklahomans.

“We are to bring good news to the poor. Payday lending is not good news to the poor. It is the worst news possible, ” said Pastor Mitch Randall, with New Haven Church in Norman.

Pastor Randall is part of a group of religious leaders who have come out against SB 1314.

The bill would allow payday loan companies to loan up to $3, 000 at a time, instead of just $500.

“They are making money on the backs of the poorest citizens of our state and that is immoral. It’s wrong and they need to be out of business, ” said Randall.

“Predatory lending, it is a debt trap. It is, they seek out those who are most vulnerable, ” said Jill Hatcher, whose husband is a pastor at First Baptist Church in Norman.

The Oklahoma Policy Institute has also come out against the bill, saying it would allow lenders to charge up to 20% monthly interest.

On a $3, 000 loan, that would be $600 every month in interest and fees.

“That’s crazy. I wouldn’t take out a loan at 240% APR, would you?” said Hatcher.

Sen. David Holt authored the bill.

“I’m not sure government’s the place to protect people from themselves. I think that may be more of a role for the churches, ” said Sen. Holt.

Holt says while he doesn’t necessarily think pay day loans are a great option, he believes in the free market and offering consumers different options; as long as there are adequate disclosures.

“If it’s a really bad financial product for people, I would like to think they won’t pursue it. And we as government don’t have to tell them that. That they will just go elsewhere, ” said Holt.

Opponents say they will work to defeat the bill, possibly replacing it with one that would drive these businesses out of our state.

“This is an evil practice, ” said Pastor Randall.

Jamie Fulmer, Senior Vice President of Public Affairs for Advance America, Cash Advance Center, Inc. sent us this statement.

“Hardworking Oklahomans value the flexibility, simplicity and reliability of regulated short-term credit products, which enjoy high customer satisfaction. Consumers are best served when they have access to a wide variety of choices, and when their local leaders foster a well-regulated, transparent marketplace. Senate Bill 1314 would do just that, offering borrowers affordable, accessible credit tailored to their needs.”

The bill passed out of committee last week and will probably go to the full Senate in a couple of weeks.

Update: Senator David Holt tweeted he will not be advancing this controversial bill.

He did so after taking some backlash on social media.

Any appeal for a less-regulated economy still appeals to me as a free market champion, but I will not be advancing SB 1314 (flex loans).

Interesting facts

|

PaydayLoansBBB Mobile Application (PaydayLoansBBB)

|

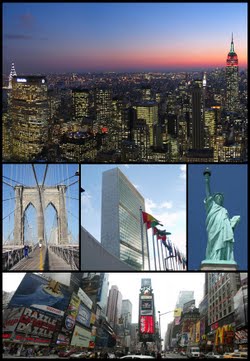

This article is about the city. For other uses, see New York City (disambiguation). For the U.S. state, see New York.

This article is about the city. For other uses, see New York City (disambiguation). For the U.S. state, see New York.