State Rep. Tom Craddick, R-Midland, speaks at a press conference on payday lending bills April 29, 2015. He is flanked by Sen. Rodney Ellis, D-Houston, left, and Sen. Royce West, D-Dallas, to his right.

State Rep. Tom Craddick, R-Midland, speaks at a press conference on payday lending bills April 29, 2015. He is flanked by Sen. Rodney Ellis, D-Houston, left, and Sen. Royce West, D-Dallas, to his right.

Lawmakers from both chambers gathered Wednesday to lend support to a range of bills that would limit the loan size and number of installments offered by payday and auto title lenders.

"We have lost some ground, and that is why it is important to do this press conference today – we have a very unified front, " said Sen. Rodney Ellis, D-Houston, standing alongside Sen. Royce West, D-Dallas, and state Rep. Tom Craddick, R-Midland. They have all filed bills aimed at regulating the payday and auto title loan industry. "We have to put this back on the front burner, " Ellis added.

The press conference came on the heels of two hearings where Senate and House committees considered bills aimed at regulating loans offered by payday and auto title lenders, collectively known as credit access businesses. While advocates of the bills have derided companies for what they consider to be predatory behavior, opponents have expressed hesitation to increase state involvement that would restrict business operations in the state.

Earlier Wednesday, the House Committee on Investments and Financial Services considered House Bill 3047, authored by Craddick, which would create a statewide law similar to city ordinances already in place across the state. The proposed legislation would limit loans to 20 percent of the borrower's annual income, allow for only four installments without refinancing and require a 25 percent principal payment to be made with each installment. It would also create a database, overseen by the Consumer Credit Commissioner, that would collect lender and borrower data.

Such businesses "pass cash along to the consumer with an often exorbitant fee, " said J. Ross Lacy, a city councilman in Midland, testifying before the committee. "This traps consumers into a debt cycle they can never recover from."

Midland, in the heart of Craddick's district, is one of 22 Texas cities that have passed ordinances limiting loans offered by payday and auto title lenders. After the ordinance went into effect, Lacy said that five of the 18 credit access businesses went out of business.

"Under the current system, [these companies] seem to benefit more from a customer's financial failure than from a consumer's financial success, " said Joe Sanchez, AARP Texas' associate state director for advocacy, adding that one in five borrowers in the state are over the age of 50.

Interesting facts

Additional information

|

PaydayLoansBBB Mobile Application (PaydayLoansBBB)

|

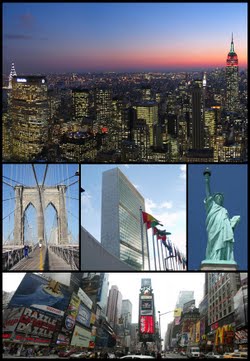

This article is about the city. For other uses, see New York City (disambiguation). For the U.S. state, see New York.

This article is about the city. For other uses, see New York City (disambiguation). For the U.S. state, see New York.