Earlier this month, the momentum behind the online lending industry was in full view at LendIt—an industry gathering that didn’t exist four years ago, but grew from about 700 attendees last year to more than 2, 500 this year. What was clear is that it’s no longer a question of whether these disruptors will change the game in small business lending, but how quickly.

Earlier this month, the momentum behind the online lending industry was in full view at LendIt—an industry gathering that didn’t exist four years ago, but grew from about 700 attendees last year to more than 2, 500 this year. What was clear is that it’s no longer a question of whether these disruptors will change the game in small business lending, but how quickly.

In fact, in his remarks at LendIt attendees in New York City, former Treasury Secretary Larry Summers predicted that online lenders could eventually capture upwards of 70% of the small business lending market. That may be an overly optimistic prediction, but one thing is clear online lending is a welcome innovation in the small business sector.

Dozens of new companies have jumped in from FundBox to Square, joining longer term players like OnDeck, Lending Club and Funding Circle. At the same time, the entrance of big money from hedge funds and institutional investors has created an energy that has gotten the attention of long-time observers of the financial industry.

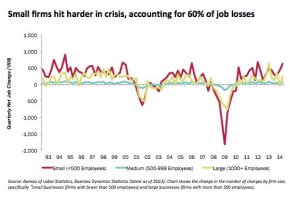

Small business owners were the hardest hit in the Great Recession due in part to their reliance on available credit. In the years following, the sluggishness of the overall economic recovery in many ways was a result of these important job creators still not being able to readily access the capital they needed from their traditional sources – banks.

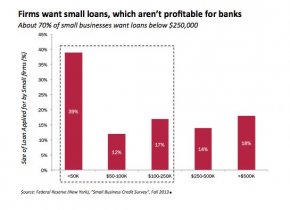

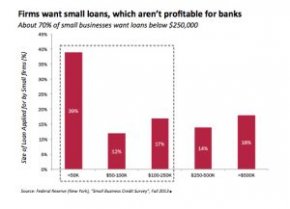

About 70% of small business want loans under 0, 000. Many banks make loans today pretty much the way they did 50 years ago, relying on expensive personal underwriting and a mountain of paperwork. That makes small dollar loans not economical. Yet, loans under $250, 000 are what most small businesses want. Add to that, the number of community banks – a critical source of small business loans – has been shrinking, from 14, 000 in 1984 to less than 7, 000 today.

Many banks make loans today pretty much the way they did 50 years ago, relying on expensive personal underwriting and a mountain of paperwork. That makes small dollar loans not economical. Yet, loans under $250, 000 are what most small businesses want. Add to that, the number of community banks – a critical source of small business loans – has been shrinking, from 14, 000 in 1984 to less than 7, 000 today.

As is often the case throughout our nation’s history, in step the entrepreneurs with dozens of new companies entering the lending space with a new approach. Much of the innovation behind these new startups is based on using technology to deliver a more streamlined application and approval process. They use new algorithms to access and analyze more data from different sources about a borrower than the traditional bank.

Today borrowers fill out an online application that typically takes 30-60 minutes. They get a response within hours and can be funded in days. This customer service is winning the attention of frustrated small business owners who on average were spending 26 hours on the loan process and waiting weeks or even months for an answer from a bank. The word is beginning to spread. In a recent Federal Reserve survey 18% of small business owners reported seeking capital online with a 38% approval rate, compared to a 31% approval rate at large national banks.

In a recent Federal Reserve survey 18% of small business owners reported seeking capital online with a 38% approval rate, compared to a 31% approval rate at large national banks.

Ease of use doesn’t grow an industry all on its own, though, but available capital does. Yes, interestingly, what’s really fueling the growth of accessible capital for small business owners is accessible capital itself. Peer-to-peer capital has given way to hedge funds and institutions looking for yield, and a hungry finance industry ready to package and syndicate the funding.

Despite the bright outlook, some worrisome questions remain. What happens to all this new capital in a downturn or when yield is available elsewhere? Can the new algorithms really predict which small businesses will succeed and which will fail? What about the high cost of some of these new loans? Regulation is largely absent in this new industry. How can small businesses really know how to pick the right product and do they know much they are paying?

How will traditional banks respond? Don’t count them out yet. There are several factors that actually could give the established players a competitive advantage. For instance, while new online lenders are spending considerable sums to find small business customers, traditional banks have thousands of those customers and have mountains of data about them.

How will traditional banks respond? Don’t count them out yet. There are several factors that actually could give the established players a competitive advantage. For instance, while new online lenders are spending considerable sums to find small business customers, traditional banks have thousands of those customers and have mountains of data about them.

At a minimum, banks are perfect partners in the new game. They can connect customers to the online platforms, share information for the credit approval processes and they can even put their capital to work as investors.

Needless to say, transformation is coming, and it’s coming in an industry that is not known for it. As Summers noted last week, former Federal Reserve Chair Paul Volker once pointed out that the only useful innovation in finance in the past generation has been the ATM.

All indicators are that this transformation will only continue to pick up its pace. As it does, one thing is clear – while investors may see gains, in all likelihood, small businesses will be the biggest winners.

Karen Mills is a senior fellow with the Harvard Business School and the Harvard Kennedy School focused on competitiveness, entrepreneurship and innovation. She was a member of President Obama’s Cabinet, serving as Administrator of the U.S. Small Business Administration from 2009 to 2013.

Interesting facts

Additional information

|

Amazon Prime: The Ultimate Guide to Prime Amazon Membership and Internet Marketing (kindle library, lending library, income online, social media, ... marketing, internet business) (Volume 2) Book (CreateSpace Independent Publishing Platform) |

|

Amazon Prime and Kindle Lending Library: The Ultimate Guide to Prime Amazon Membership and Internet Marketing (Alexa Kit, Amazon Prime, users ... business, echo , amazon prime) (Volume 1) Book (CreateSpace Independent Publishing Platform) |