If you have a poor credit score, the best rates for credit cards, personal loans, mortgages and auto financing may be unavailable to you. However, you may still be able to borrow - there are products that are tailored to meet the needs of consumers with low credit scores.

If you have a poor credit score, the best rates for credit cards, personal loans, mortgages and auto financing may be unavailable to you. However, you may still be able to borrow - there are products that are tailored to meet the needs of consumers with low credit scores.

Poor Credit Mortgages

If you have bad credit, you may still be able to get a mortgage - that's because if you fail to pay as agreed, the lender can foreclose and take back the property. Minimum credit scores for FHA financing are 580 for loans with 3.5 percent down, and 500 for loans with ten percent down. However, very few applicants in that range actually get approved for FHA mortgages. If your score is low because you have too many accounts, your credit history is too short, or you are the victim of identity theft, then you have a good chance at government-backed home financing. However, if your score is low because you habitually miss payments or because you have some seriously derogatory information on your credit report, then your chances of approval are very slim.

One way to up your chances of getting a mortgage is to increase the size of your down payment. You might be turned down for a 96.5 percent loan with a 580 credit score, but approved for a 95 percent or 90 percent mortgage.

Poor Credit Credit Cards

The offers available to you depend on just how bad your credit is. Boderline bad gets you higher interest rates and fees, and lower credit limits, but you may still be able to get an unsecured card. If you're smart and clear your balance every month, the card's interest rate won't matter, and over time you can improve your credit rating.

Lower scores (i.e, scores below 580) could keep you from getting an unsecured card. In that case, you'll need to put up a deposit equal to your credit limit and get a secured card. In effect, you're paying to borrow from yourself. These secured credit cards can be helpful, however. They can allow you do things like rent cars and reserve hotel rooms - activities that normally require some kind of plastic - and they can help you rebuild credit.

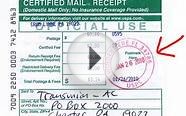

To rebuild your credit, choose a card from an issuer that guarantees in writing it will report your payment history to the three big credit bureaus - Experian, TransUnion and Equifax. Otherwise, it's useless for credit building. Be careful when comparing secured cards - sometimes what looks like a reasonable service charge - $15 a year - is actually a very unreasonable $15 a month. One card marketed to people trying to rebuild their credit scores charges more than $200 in fees per year and comes with a 36 percent APR.

You may also opt for a debit card, which is attached to your checking account and does not involve any actual extension of credit, nor will it help you rebuild a score. However, it allows you to conveniently pay for things.

If you can't qualify for a secured card, the other option is a pre-paid card. You pay the issuer its fee plus the amount you want to be able to charge. You get a card that allows you to pay for things, but as no credit is extended, you won't improve your credit score. Fees for these cards can be quite high, so compare offers carefully.

Poor Credit Auto Loans

Just because you have a poor credit score doesn't mean you shouldn't try for the best rate available to you. Comparing offers from several lenders helps you avoid overpaying for automotive financing.If you have bad credit, you can probably get an auto loan as long as your income is good, you make a substantial down payment and you pay a high interest rate. Auto loans are secured by the vehicle, which can be repossessed if you fail to repay the lender as agreed. If your down payment is high enough, the lender won't lose money if you default. Many auto financing companies will offer you better terms if you have a co-signer with good credit. Don't go this route, however, unless you're absolutely sure that you'll make every payment on time - because if you don't, your co-signer's credit score will be affected.

Poor Credit Personal Loans

Personal loans, like credit cards, are unsecured. That means the lender is relying on your character, and it sees your credit score as an indication of your character. It's not easy to get a personal loan with really bad credit. Loan amounts are smaller, and interest rates are high - over 30 percent for the lowest credit grades.

One caution: you may see advertisements for personal loans for bad credit or with no credit check. Those are not real personal loans - they are almost always payday loans, check advances or title loans, which come with extremely high interest rates (over 100 percent), very short terms (14 days to several weeks) and relatively low loan amounts.

Interesting facts

Additional information

|

Instant Referrals for Mortgage Professionals: A Proven System for Capturing More Agents, Closing More Loans and Becoming THE 'Go-To' Lender In Your Area Book (CreateSpace Independent Publishing Platform) |