You’re out of inventory, a tornado tore off the roof — or you’ve encountered a golden opportunity. Whatever the reason, you need fast cash. But if you have bad credit or no collateral, you may not be able to get a small-business loan. A merchant cash advance could be your best bet.

With a merchant cash advance, you receive a lump sum of cash upfront, and the lender is repaid by claiming a percentage of your future credit and debit card sales.

Although merchant cash advance loans come with high approval rates and fast access to capital, you’ll pay for that speed and convenience in the form of sky-high borrowing costs. For this reason, small-business owners should consider other financing options first.

How a merchant cash advance works

A merchant cash advance is financing for companies that have credit or debit card sales, such as restaurants or retail businesses. Unlike a regular loan, which is repaid on a fixed schedule (typically weekly, biweekly or monthly), MCAs are repaid daily. A percentage of your credit or debit card sales is withheld until the agreed-upon amount has been repaid in full.

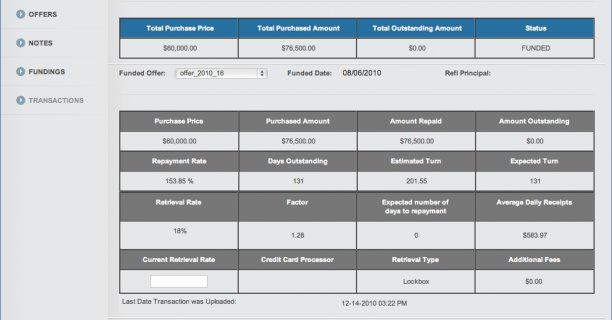

Let’s say you need $50, 000 to purchase a new oven for your restaurant, which you expect to increase sales. You apply and get approved for an MCA of $50, 000. Fees are determined by a factor rate, so multiply your advance by the factor rate, and you’ll have your repayment amount and total fees:

| Advance | Factor Rate | Total Fees | Total Repayment |

|---|---|---|---|

| $50, 000 | 1.4 | $20, 000 | $70, 000 |

A fixed percentage is automatically deducted from your credit and debit card sales until the entire $70, 000 is collected. The average repayment period typically ranges from three to 12 months. The higher your credit card sales, the faster you’ll repay the MCA.

In this case, let’s say you agree to deduct 10% of your monthly credit card sales until the total amount is repaid ($70, 000), and your business averages $100, 000 in credit card revenue per month. You’d repay $10, 000 monthly, and at this pace, the advance would be repaid in full by the seventh month. But if your sales drop to $70, 000 in revenue per month, the MCA wouldn’t be repaid in full until the 10th month.

Nerd note: Small-business owners should understand that MCAs are far from a perfect borrowing option and come with several drawbacks. But first, here’s what makes MCAs attractive to some borrowers.

Pros of merchant cash advances

- They’re quick. One of the biggest advantages of MCAs is that the money can be obtained very quickly — often within a week or so — with no heavy paperwork to slow things down. MCA providers will look at your business’s daily credit card receipts to determine if you can repay the money, so they will likely require that you provide bank statements and credit card receipts during the application process.

- You won’t lose your home. MCAs are unsecured loans, so collateral is not required. This means you don’t have to forfeit any personal assets (such as your home) or business assets if your sales plunge and you fail to repay. Businesses that can’t qualify for a bank loan because of collateral requirements typically can qualify for an MCA if they have strong credit card sales.

- When sales are down, your payment is too. Because the repayment schedule is based on a fixed percentage of your sales, repayments adjust based on how well your business is doing. So if sales are lagging, you repay less, giving you more flexibility to manage a slowdown in business.

Interesting facts

Additional information