I know what it is like to look for a loan. While you usually have your finances in order, a sudden situation has caused you to need a little extra cash. Perhaps you are having a medical emergency. Maybe you are trying to pay off your credit cards and want to consolidate your debt at a lower interest rate. Whatever the case, there are a number of places where you could go for a loan, and Wells Fargo is one of those places.

I know what it is like to look for a loan. While you usually have your finances in order, a sudden situation has caused you to need a little extra cash. Perhaps you are having a medical emergency. Maybe you are trying to pay off your credit cards and want to consolidate your debt at a lower interest rate. Whatever the case, there are a number of places where you could go for a loan, and Wells Fargo is one of those places.

Loans up to $35, 000 via Lending Club

The problem is, they are not the best option. They are used by people only because they are popular. Wells Fargo is one of the biggest banks in the United States, people wanting a loan often choose Wells Fargo because their billboards and banks are visible in every major city.

A much much better option is applying for a loan through Lending Club. And while you might not have heard of Lending Club before, it is a really good idea to explore all the options before settling on a Wells Fargo personal loan. Looking at another option is what we will be doing today.

Getting an Online Unsecured Loan: A 6-Step Process

Getting an Online Unsecured Loan: A 6-Step Process

Getting an unsecured loan over the internet is basically the same six steps wherever you go.

Step #1: Fill Out an application

The first thing you have to do is fill out an initial application asking for a loan amount and term. A loan’s term is the number of years you want the loan to be paid back (for Wells Fargo, they offer 1-year to 5-year loans). You will also have to submit some basic information like your date of birth and yearly income. This allows the company to pull your credit history.

For Wells Fargo, online applications are only accepted from people who have had an account with them for at least a full year. If you are brand new to Wells Fargo, you will have to visit one of their branches if you want to apply for a personal loan.

Step #2: Your Loan is Approved (or Denied)

Step #2: Your Loan is Approved (or Denied)

Once your information is submitted, companies like Wells Fargo will crunch the math of your application. They will look at the big picture (your credit history and current income) and score you to see if you qualify for a loan.

Often this is when borrowers get declined. The big three reasons why banks decline a loan application is because:

- the credit history is too young (earliest credit line is too recent or has too few lines of credit)

- the credit has too many negative marks (late payments, etc)

- years of employment or yearly income is too low

Step #3: Get Quoted an Interest Rate

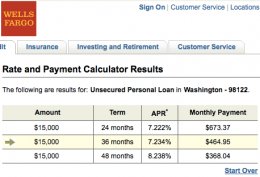

If you meet their minimum credit score, they will offer you an interest rate for the loan amount and term you requested. For instance, if I go to the, I see that the best rate they offer people is 7.2% (though most people will get a rate higher than this).

Step #4: Accept the Interest Rate

Alright! Once you apply for a loan, get qualified, and get offered an interest rate, you have the choice to either accept or turn down the loan. This is a really important step in the process. If you find this interest rate to be too high, you need to consider looking elsewhere. An interest rate that is too high means huge fees for your loan over the years you pay it back.

For example: if I got the $15, 000 3-year loan in the above picture, I would pay $1, 730 in interest. But if Wells Fargo offered me a higher rate like 12%, then I would pay $3, 000 in interest! That is a difference of $1, 300, a solid reminder that interest rates are important.

In short, you need to find the lowest rate possible before you accept a loan’s offer.

Step #5: Get the Cash

If you do get qualified and accept the loan, the amount is then transferred to your bank account, usually electronically, though some banks just write you a check.

With Wells Fargo, the only way to get this check is by driving to an actual branch and going inside to sign the forms in person. This may be inconvenient for some, but doing this allows Wells Fargo to possibly get people cash the same day they apply for a loan.

Interesting facts

Additional information